Investing in real estate in 2025 offers diverse opportunities, from traditional property purchases to innovative digital platforms and REITs. With technology driving smarter decisions, investors can analyze market data, forecast trends, and identify high-growth areas more accurately than ever before. Consider residential, commercial, or vacation rentals depending on your goals.

Crowdfunding platforms and fractional ownership also allow for lower entry barriers. It’s crucial to assess location, rental yield, legal compliance, and financing options. Diversification and long-term planning reduce risk, while sustainable and tech-integrated properties are gaining popularity. Real estate remains a strong hedge against inflation and a stable wealth-building strategy.

Table of Contents

- Introduction

- Understanding Real Estate Investment Options

- Market Trends Shaping 2025

- Step-by-Step Guide to Investing in Real Estate in 2025

- Leveraging Technology for Smarter Investments

- Risks and Challenges in 2025

- Taxation and Legal Considerations

- Real Estate Investment Strategies for Different Investor Types

- Conclusion

1. Introduction

- Real estate has long been one of the most stable and profitable investment options available. In 2025, it continues to hold strong appeal for both new and seasoned investors, but the landscape has evolved dramatically. Advances in technology, shifts in global economic dynamics, and changing lifestyles have reshaped how people buy, sell, and manage properties.

- The traditional model of simply purchasing a home and renting it out for passive income has now expanded into a dynamic, tech-driven market full of innovative strategies and diversified asset classes.

- Today’s investors must navigate an environment influenced by smart cities, remote work trends, and digital platforms like blockchain and crowdfunding. Whether you’re interested in physical properties, Real Estate Investment Trusts (REITs), or fractional ownership through tokenized assets, there’s a strategy tailored to your financial goals and risk tolerance. Sustainability also plays a larger role than ever before.

- This guide explores how to invest in real estate in 2025, covering everything from traditional methods to emerging digital opportunities. Whether you aim to build long-term wealth, create passive income, or diversify your investment portfolio, understanding the current trends and tools is key to success in this fast-evolving market.

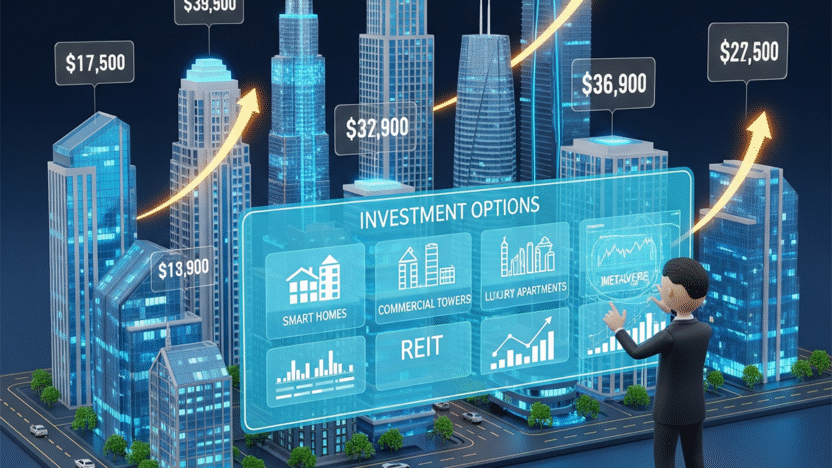

2. Understanding Real Estate Investment Options

Investing in real estate in 2025 goes far beyond simply buying a house or apartment. Today’s market offers a diverse range of options suited to different budgets, risk profiles, and investment goals. Whether you’re looking for stable income, capital appreciation, or portfolio diversification, the right choice depends on your financial strategy and market understanding.

Let’s explore the primary real estate investment options available in 2025.

1) Residential Properties

Residential real estate remains the most popular investment choice, especially for individual investors and beginners. It includes:

- Single-Family Homes: A classic starting point, these are relatively easy to manage and sell. They typically attract long-term tenants and offer stable rental income.

- Multi-Family Units: Duplexes, triplexes, and apartment buildings allow investors to generate multiple income streams from a single property. They offer economies of scale but may require more active management.

- Condominiums and Townhouses: These often come with lower maintenance responsibilities, as building upkeep is managed by homeowners’ associations (HOAs), but they include monthly fees.

2) Commercial Real Estate

Commercial real estate (CRE) is geared toward experienced investors seeking higher returns. CRE includes:

- Office Buildings: Once dominant, office space has been reshaped by remote work. In 2025, mixed-use spaces and coworking hubs are replacing traditional office setups.

- Retail Properties: With eCommerce changing consumer habits, retail properties are evolving. Grocery-anchored centers, niche boutiques, and service-based tenants are still profitable.

- Industrial and Warehouses: These have surged in demand due to online shopping and logistics expansion. Industrial real estate is often seen as a strong, long-term bet.

3) Vacation Rentals

The rise of digital nomads and travel influencers has fueled the vacation rental market. Platforms like Airbnb, Vrbo, and Booking.com make it easier than ever to profit from short-term rentals.

Vacation rentals are especially lucrative in tourist hotspots and urban centers. However, they come with unique challenges:

- Seasonality and occupancy fluctuations

- Local regulations and licensing

- High maintenance and operational demands

4) Real Estate Investment Trusts (REITs)

For those who prefer a hands-off approach, REITs are an excellent option. A REIT is a company that owns, operates, or finances income-generating real estate. Investors buy shares of a REIT just like they would a stock, receiving dividends from rental income.

- Publicly Traded REITs: Easily bought and sold on stock exchanges, offering liquidity and transparency.

- Private REITs: These may have higher returns but are less liquid and carry more risk.

3. Market Trends Shaping 2025

The real estate market in 2025 is being shaped by a convergence of global trends, economic shifts, and technological advancements. To invest successfully, it’s critical to understand the forces transforming the industry. Let’s explore the key trends influencing property values, demand, and investment strategies this year.

1) Urban Migration & the Rise of Secondary Cities

While major metropolitan hubs like New York, London, and Tokyo continue to thrive, many investors in 2025 are turning their attention to secondary cities and emerging urban centers. These areas offer:

- Lower entry prices

- Higher rental yields

- Government incentives for development

2) Smart Cities and PropTech Integration

Real estate is embracing smart technology and automation at unprecedented levels. Properties equipped with Internet of Things (IoT) devices, smart meters, and energy-efficient systems are now considered premium assets. In 2025:

Smart homes attract tech-savvy renters and buyers

- AI-powered property management tools optimize maintenance and leasing

- Virtual reality tours and digital twins enhance the buying process

3) Sustainability and Green Real Estate

Eco-conscious investing is no longer a niche is mainstream. Governments, especially in Europe, North America, and parts of Asia, are incentivizing energy-efficient construction and penalizing outdated, carbon-heavy buildings.

Key green real estate trends include:

- LEED-certified buildings

- Solar panel installations

- Net-zero energy buildings

- Rainwater harvesting and waste management systems

4) AI and Big Data in Real Estate Decision-Making

In 2025, artificial intelligence and big data analytics have become indispensable tools for property investors. Platforms now offer:

- Predictive pricing models

- Rental yield forecasting

- Neighborhood growth analysis

- Tenant screening automation

5) Evolving Government Policies and Housing Reforms

Real estate investment is heavily influenced by national and local government regulations. In 2025, policymakers are reacting to rising housing costs, climate change, and demographic shifts. Common policy trends include:

- Rent control laws in major urban areas

- Incentives for affordable housing developments

- Tax benefits for green building investments

- Restrictions on foreign ownership in high-demand regions

4. Step-by-Step Guide to Investing in Real Estate in 2025

Investing in real estate in 2025 requires a strategic, informed approach. With diverse opportunities and new technologies available, investors must blend traditional principles with modern tools. Whether you’re a first-time buyer or a seasoned investor, following a structured process can help you minimize risk, maximize ROI, and build long-term wealth.

1) Define Your Investment Goals

Start by clearly outlining what you want to achieve with your real estate investment. Your goals will shape every decision, from the type of property you choose to how you manage it.

Common investment goals include:

- Generating passive income through rental properties

- Capital appreciation by holding and selling at a higher value

- Tax benefits and deductions

- Diversifying your investment portfolio

- Building generational wealth

2) Conduct Market Research

In 2025, data-driven research is key to identifying profitable real estate opportunities. Use tools powered by AI, big data, and predictive analytics to:

- Analyze neighborhood demographics and income levels

- Forecast property value trends and rent growth

- Study local development projects and zoning regulations

- Evaluate crime rates, school ratings, and accessibility

3) Set a Budget and Explore Financing Options

Next, determine how much capital you can invest and how you’ll finance your purchase. Your financing strategy will affect your cash flow, leverage, and risk profile.

- Traditional mortgages: Fixed-rate or variable-rate, depending on inflation and interest rates.

- Private lenders or hard money loans: Faster but more expensive; suitable for short-term projects like house flipping.

- Real estate crowdfunding platforms: Ideal for fractional ownership with lower entry costs.

4) Choose the Right Property Type and Location

Based on your goals, budget, and market research, select the property type and location that best aligns with your strategy.

Property Types:

- Single-family homes: Good for beginners; stable rental demand.

- Multi-family units: Higher income potential, economies of scale.

- Commercial properties: Higher returns but higher risk and complexity.

- Land or development properties: High long-term potential with greater upfront risk.

Location Factors:

- Economic and job growth

- Infrastructure and transport connectivity

- Access to schools, hospitals, and public services

5. Leveraging Technology for Smarter Investments

In 2025, real estate investment has gone digital in nearly every aspect. From analyzing deals to managing properties remotely, technology has transformed the investment process into something more accessible, data-driven, and scalable.

1) AI-Powered Property Analysis Tools

Artificial Intelligence (AI) has revolutionized property research and investment forecasting. In 2025, AI platforms can:

- Analyze neighborhood growth potential

- Predict future property values

- Evaluate ROI, cap rates, and cash-on-cash returns

2) Virtual Reality (VR) and Augmented Reality (AR)

Gone are the days when investors had to physically visit every property. VR and AR are now standard in the real estate investment toolkit.

- Virtual tours allow you to walk through properties from anywhere in the world.

- AR apps can simulate renovations or staging, helping you visualize potential changes and costs before purchasing.

3) Blockchain and Smart Contracts

Blockchain technology has introduced unprecedented transparency, speed, and security to real estate transactions.

- Smart contracts automate buying, leasing, and selling without intermediaries, reducing legal and administrative costs.

- Tokenization breaks down property ownership into digital tokens, allowing investors to buy fractions of high-value assets and diversify their portfolios with smaller capital.

4) Big Data & Predictive Analytics

Data is the new currency in real estate. In 2025, predictive analytics enables investors to forecast:

- Future rental demand in specific ZIP codes

- Likelihood of tenant defaults

- Long-term ROI based on macroeconomic and local trends

- Ideal rent pricing models for different markets

5) Property Management Automation

Technology isn’t just for buying and selling—it also plays a major role in efficient property management. Automation tools now handle:

- Rent collection and reminders

- Lease renewals and documentation

- Maintenance requests and scheduling

6. Risks and Challenges in 2025

While real estate continues to be a powerful investment vehicle, 2025 presents a unique set of risks that investors must proactively navigate. A deeper understanding of potential pitfalls that can be economic, technological, regulatory, and environmental can help protect your investment and position you for long-term success.

1) Market Volatility and Economic Uncertainty

Real estate markets in 2025 are still responding to macroeconomic aftershocks such as inflation, global conflicts, and supply chain disruptions.

- Slower property appreciation

- Declining rental demand in certain regions

2) Rising Interest Rates and Financing Hurdles

After years of low rates, 2025 is seeing sustained fluctuations in mortgage and loan rates. This affects:

- Borrowing power, especially for first-time investors

- Cash flow projections due to increased monthly repayments

- Refinancing options for existing properties

3) Regulatory Pressures and Policy Shifts

Governments around the world are responding to housing shortages, inflation, and sustainability goals with tighter regulations. These may include:

- Rent control laws in high-demand cities

- Bans or restrictions on short-term rentals (e.g., Airbnb)

- Increased taxes on investment properties or foreign buyers

- Mandatory green certifications or building code updates

4) Technology Risks and Platform Dependency

While proptech and AI have improved accessibility and efficiency, they also bring new risks:

- Cybersecurity threats: Investment platforms and smart home devices are vulnerable to hacking or data breaches.

- Platform instability: Crowdfunding platforms or tokenized real estate systems could collapse or change business models.

5) Environmental and Climate-Related Challenges

Climate change is becoming a major concern in real estate. Properties in high-risk zones of floodplains, wildfire-prone areas, or coastal regions are:

- More expensive to insure

- More likely to depreciate over time

- Subject to stricter environmental compliance laws

7. Taxation and Legal Considerations

Understanding the tax and legal landscape is critical to protecting your investment and maximizing returns. In 2025, tax policies are evolving alongside technological advancements and increased government oversight.

1) Real Estate Tax Benefits

Real estate remains one of the most tax-advantaged investment types. Key tax benefits in 2025 include:

- Depreciation Deductions: Even as your property appreciates in value, the IRS and many global tax systems allow you to deduct a portion of its value annually, reducing taxable income.

- Mortgage Interest Deduction: Investors can deduct interest on loans used to purchase or improve rental properties, easing financial burdens in high-interest environments.

- Operating Expense Deductions: Expenses like repairs, maintenance, utilities, property management fees, travel, and marketing costs are often tax-deductible.

2) Capital Gains and Income Tax

Profits from selling a property or earning rental income may be subject to taxation:

- Short-term capital gains (properties held less than one year) are taxed at ordinary income rates.

- Long-term capital gains (held more than one year) often benefit from reduced rates.

- Rental income is typically taxed as ordinary income but can be offset by deductions.

3) Legal Structures for Protection and Optimization

Choosing the right ownership structure can shield you from liability and offer tax advantages:

- Limited Liability Companies (LLCs): Popular for protecting personal assets and simplifying tax reporting.

- Trusts: Useful for estate planning, asset protection, and tax efficiency.

- Partnerships or Syndicates: Common in group investments and crowdfunding platforms.

4) International and Cross-Border Considerations

If you’re investing outside your home country:

- Understand double taxation treaties

- Know the foreign ownership laws and title rights

- Ensure you report foreign assets if required by your country’s tax authority.

8. Real Estate Investment Strategies for Different Investor Types

Every investor enters the real estate market with a unique profile is defined by experience, risk tolerance, financial goals, and available capital. In 2025, the breadth of investment options and digital tools makes it easier than ever to tailor your strategy to your specific needs.

1) First-Time Investors

Goals: Build foundational wealth, gain experience, minimize risk.

Recommended Strategies:

- Start Small: Consider single-family rentals or duplexes in suburban or secondary markets with low entry costs.

- Use FHA or low-down payment loans: Especially if you plan to house hack (live in one unit, rent the rest).

2) High-Net-Worth Individuals (HNWIs)

Goals: Preserve and grow wealth, diversify holdings, minimize taxes.

Recommended Strategies:

- Invest in Commercial Real Estate: Office spaces, mixed-use developments, and industrial warehouses can offer high returns and long-term tenants.

- Diversify Across Geographies: Allocate capital in international markets or tax-advantaged jurisdictions.

3) Passive Investors

Goals: Generate income without direct involvement.

Recommended Strategies:

- Public or Private REITs: Offers exposure to diverse real estate portfolios with liquidity and regular dividends.

- Real Estate Crowdfunding: Platforms like CrowdStreet and RealtyMogul let you invest in vetted projects passively.

9. Conclusion

- Real estate in 2025 stands at the intersection of tradition and innovation. While the foundational principles of smart investing, which are due diligence, location analysis, and long-term planning, remain unchanged, the tools, strategies, and opportunities have evolved significantly.

- From tokenized digital assets and AI-powered analytics to eco-conscious building trends and global investment platforms, the modern investor has more resources and flexibility than ever before.

- Whether you’re aiming to build passive income, diversify your financial portfolio, or preserve intergenerational wealth, real estate continues to be a resilient and rewarding asset class. The key lies in matching your investment approach to your goals, staying informed about market trends, and adapting to new technologies and regulatory environments.